Cryptocurrencies and similar digital assets are reshaping the financial landscape, making clear and trustworthy communication more essential than ever. Businesses operating in – or exposed to – this sector need strategies that build confidence, educate audiences, and establish credibility

In this article, Jared Wright, Senior Account Manager, explores how effective communication can demystify digital assets, address trust challenges, and connect these innovations to broader wealth strategies. Honner is currently assisting clients to engage with key policymakers including Ministers, Shadow Ministers and industry groups on digital assets.

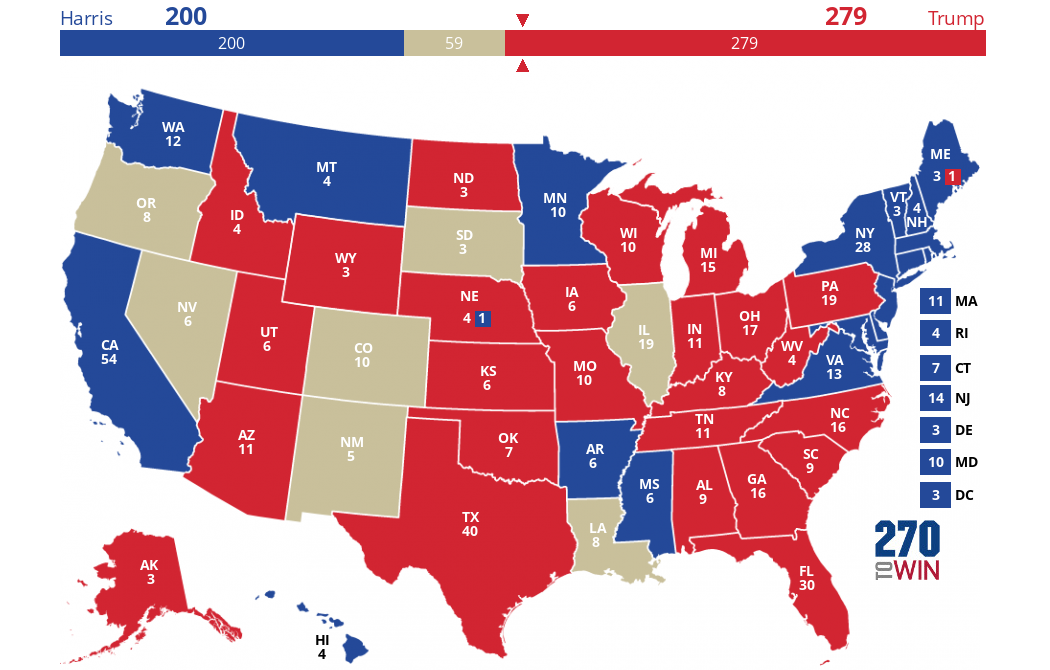

The digital asset market stands at a crossroads, with governments and regulators globally catching up to the rapid growth of cryptocurrencies and blockchain technology. The industry has experienced a bull run since the announcement that Donald Trump would become US President, given his pro-crypto stance. As market valuations have increased, so to has investor interest in this emerging asset class.

For businesses navigating this landscape, clear, strategic communication will be critical in establishing trust and fostering growth as the market matures.

Communicating in a rapidly evolving regulatory landscape

Governments and regulators are stepping up their efforts to create a robust framework for digital assets. In Australia, ASIC has been at the forefront, working on regulations to protect investors while enabling innovation. With only 40 out of 400 crypto-related businesses licensed, ASIC’s focus on enforcement has sent a strong message to the industry: compliance is no longer optional.

Despite the introduction of numerous consultation papers, the Federal Government is yet to put forward any legislation in this space, meaning debate within the Parliament is unlikely until after the upcoming election.

For businesses, this creates both challenges and opportunities. Effective communication strategies can help organisations stay ahead by demonstrating their commitment to transparency, investor protection and regulatory alignment.

Key communication strategies for a maturing market

Proactive engagement with regulatory themes

- Positioning on compliance: Highlighting adherence to licensing and regulatory standards can reinforce credibility and trust.

- Clarity on legal obligations: Providing accessible, clear messaging around complex regulatory requirements ensures audiences understand how your business operates responsibly.

Framing digital assets as part of broader financial strategies

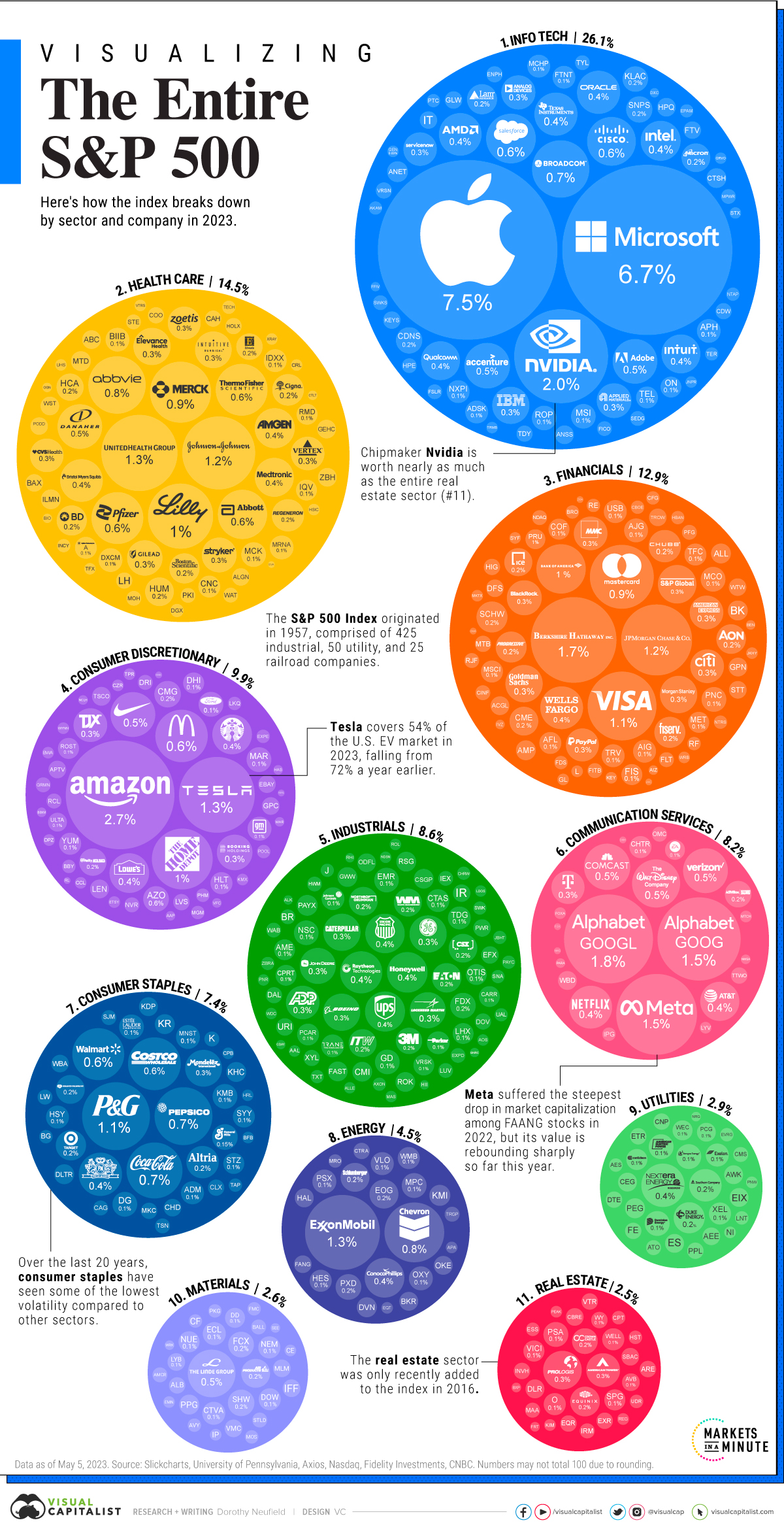

- Integration and diversification: Emphasising how digital assets complement traditional portfolios can demystify their role for both institutional and retail investors.

- Wealth creation and security: Positioning digital assets within a long-term financial strategy aligns with the values of stability and foresight that regulators and investors seek.

Educational campaigns to build trust

- Simplifying complex concepts: Explaining tokenisation, DeFi, and staking in plain language bridges the knowledge gap for audiences unfamiliar with these innovations, particularly retail investors.

- Showcasing use cases: Highlighting tangible benefits of blockchain, such as its ability to revolutionise payments and financial transactions.

Crisis communication and risk management

- Addressing reputational challenges: Past events like the FTX collapse underscore the importance of clear, honest communication in navigating crises.

- Proactive risk disclosure: Transparently outlining the potential risks associated with digital assets builds credibility and confidence.

Leveraging regulatory developments as communication opportunities

As ASIC and global counterparts develop frameworks for licensing, compliance, and market integrity, businesses should seize the opportunity to position themselves as industry leaders. For example:

- Engage with policymakers: Demonstrating collaboration with regulators highlights a commitment to shaping a sustainable future. Honner has assisted clients to engage with key policymakers including Ministers, Shadow Ministers and industry groups.

- Thought leadership on regulation: Publishing insights or hosting discussions on regulatory themes positions your business as a credible voice in the industry.

Building a future of trust and innovation

The maturation of the digital asset market presents a unique opportunity for businesses to lead with strong, clear communication strategies. By aligning with evolving regulations, educating investors, and proactively engaging with policymakers, organisations can position themselves as trusted partners in the journey toward integrating digital assets into the broader financial system.

At Honner, we specialise in helping clients navigate this complex landscape, delivering strategic communications that build trust, enhance understanding, and foster long-term growth. Whether you’re preparing for regulatory change, engaging with investors, or positioning as an industry leader, we can help you shape a future where digital assets are a secure and integral part of financial portfolios.