I’ve decided to start this blogpost with a cranky headline. Much like Dr Bruce Banner before turning into The Hulk in the first Avengers movie, I will also let you in on my secret: despite not showing it, I am always angry… whenever I hear someone call news coverage “a great outcome”. It’s not… And calling it that can cause us to drift away from our objectives.

Don’t get me wrong, favourable news coverage does make me happy, especially whenever my team and I have been working hard to attain this. My point is the outcome of our PR strategy and activities – the actual communication outcome – is something that can’t be seen in any news coverage analysis. Positive coverage does not automatically mean positive reputation. That is a far-fetched assumption, especially if we’re only looking at earned media to asses reputation. To understand the outcomes of our campaigns, we must look beyond.

To begin with, communication happens not when news is published or advertising is displayed, but when our target market reads or listens to what we say or is said about us, and when they understand, accept or respond to the stories that involve us. Likewise, it also happens when we listen, understand, accept or respond to the messages from our target audience – that is, if we accept the notion of stakeholder capitalism.

But even if we are still passionately attached to the old paradigm of shareholder capitalism, where the sole role of PR is to persuade a target market to think or act in a desired way about a brand or product, the real communication outcome can mostly be observed through market research, using techniques such as surveys, focus groups and in-depth interviews, among others, not by running news coverage analyses and making fancy-looking graphs with the clips achieved.

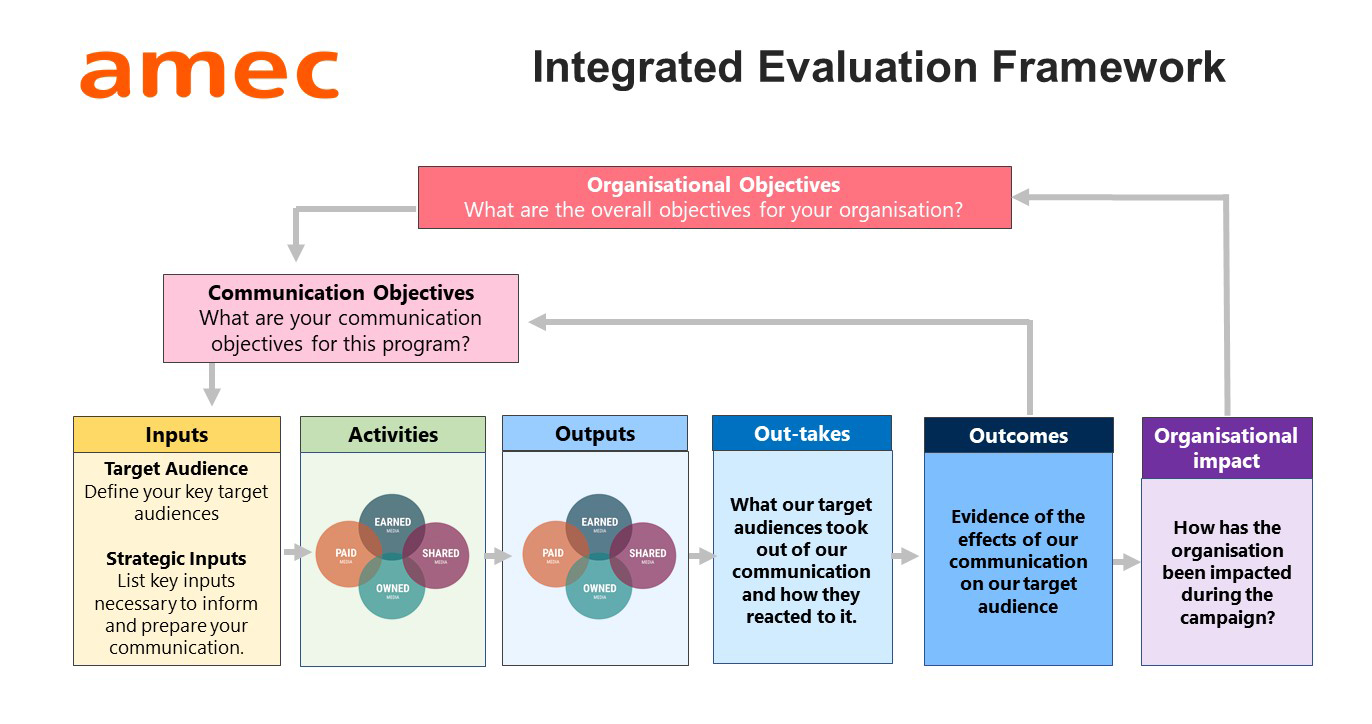

This approach to measurement and evaluation has been proposed by the International Association for Measurement and Evaluation of Communication (AMEC) since the publication of the Barcelona Principles in 2010 (updated in 2015), and more recently, with the appearance in 2016 of the Integrated Communications Measurement Framework. The framework distinguishes between Objectives (SMART ones), Output (our story and messages communicated to our target audience), Out-takes (immediate reaction of our audience and information recall of a story, organisation or product) and Outcomes (effects in the attitudes, opinion and behaviour of our audience towards a story, organisation or product). At least a version of this is worth considering for structuring an integrated communications program or campaign.

Let’s go back for a minute to the fancy-looking graphs. To clarify, these graphs with news coverage segmented by prominence, favourability, audience, reach, themes, message cut-through, visual impact, etc. do have a role, an important one even. They help us to stir a program in different directions if needed, and they might even be useful for generating KPIs. But if we’re aiming to have in place a sound strategy across all media with measurable communication objectives that can aid the organisation’s business goals, it’s critical to consider news coverage for what it is – which is, output, not outcome.

It’s also important to note for anyone that made it this far down in this cranky blogpost that a clear taxonomy of concepts is not an end in itself. The ultimate benefit of referring to news coverage for what it is is that it allows us to look at the big picture, which is first and foremost, our communication objectives. What is it that we’re trying to do? Is it increasing brand awareness among a specified segment of the market from 10% to 15% in the next 12 months? Is it to replace A for B as the most associated brand attribute, assuming A will help the organisation to increase leads or conversions? Is it to decrease from 20% to 15% the percentage of people who are currently not considering buying our products in the near future? Is it to lower from 60% to 20% in three years the amount of people with a specific misperception about our organisation and its services? All these are examples of the right questions to ask whenever communicational objectives are discussed and agreed on in writing.

Only once these communication objectives have been achieved, can we truly say that our integrated program across all media teams has jointly achieved a “very good outcome”.

Month: March 2020

Communication strategies to support nervous investors: a guide for fund managers

While we can’t predict the future, Honner has more than 20 years of experience in building communication strategies and supporting asset management firms, financial advisers and individual investors during volatile times. This included the GFC, September 11 attacks and dot com bubble.

Today we are facing a new crisis. The coronavirus is currently spreading, bringing with it panic and anxiety for investors of all types around the globe. At the time of publishing this article, the weekly fall in the Dow Jones Industrial Average ranks within the top 15 in its 124-year history and it was the worst week for stocks since the global financial crisis.

In an industry where it is difficult to differentiate your offering, quality, timely communications and the way you deliver it can clearly distinguish your brand. Here we’ve identified some key communication strategies that can make your brand stand out during this period of uncertainty:

1. Be visible, open and honest: One of the key aspects we’ve learnt from periods like this is that people understand and accept that markets can be volatile but they won’t forgive a lack of support, a lack of transparency, and slick cliché messages that aren’t helpful (similar to the lesson Scott Morrison learnt during the recent bushfire crisis). In difficult moments such as this, companies need to prioritise timely communications that are transparent and provide valuable insight to employees, financial advisers, investors and the media.

2. Consider building a communication response team: If the crisis moves from days to weeks, fund managers should consider creating a core communication team that has responsibility for managing the communication process. This should be a small nimble team that includes representation from across the business (from your marketing, client service, sales, and investment teams and also your communication agency). The team should be empowered to mobilise and respond quickly, and to act as a contact point for the entire firm, while also being responsible for building and maintaining a long term communication plan that evolves with the unfolding situation.

3. Pick a spokesperson: Consider picking a spokesperson to be the voice of the firm during the crisis—to show consistency for the brand. This should be someone who can connect with people easily, is sincere and transparent during interviews, and has experienced extensive media training.

4. Support financial advisers to do their jobs: When a market correction hits, the first place many investors turn is to their financial advisor. This can be a stressful time for a financial adviser. It is also the ideal time for a fund manager to step up to support financial advisers with valuable content these advisers can use en masse with their own clients—to help calm their clients and provide emotional support.

5. Create content that adds value, is visual and uses historical data to tell the story: Try and avoid long copy articles. Focus on visual content that ideally draws on historical data and supports your key supporting messages. Don’t focus on what has occurred with the market. Rather, try to highlight your current portfolio positioning. Some examples of key content pieces doing this well include:

- The cycle of market emotions image from Russell Investments is a powerful snapshot of how investors typically make the wrong decisions at the wrong time. Russell Investments’ downside management toolkit on their website is also a good example for other fund managers to follow.

- The market volatility section of Franklin Templeton website.

- Fidelity has created strategies for uncertain times, a guide for investors on “What to consider when the market gets volatile”. Most of the largest asset managers in the world have still to reflect the market correction on their public facing sites, which is disappointing.

- Vanguard has an interactive chart that allows you to build your own customised version of the index chart with 30 years of investment performance of major asset classes. (They just need to update it to reflect recent correction.)

- Capital Group created an illustration using historical data highlighting the dangers of investors sitting on the sidelines and the benefits of investing – even by selecting the worst day each year to invest.

- Schroders has produced a strong piece: coronavirus: the investment impact in seven charts.

- Investors Mutual have produced a piece that details how does this impact iml’s portfolios and what are we doing about it?

6. Create a coronavirus content hub for investors: Too much content can become overwhelming and become quickly out of date during such a dynamic period. Consider creating a specialist area on your website that houses all content related to the coronavirus market event. Too often firms distribute a lot of communications and content pieces—but as the situation unfolds and changes it can become confusing for your clients. The hub can also be a great resource for employees to ensure they are accessing the latest information. See the examples above of fund managers that are nimble and have websites that reflect the market correction.

7. Repurpose old content: Look at some of your previous material on investor tips and see what can be quickly updated and repurposed for this situation. You may not need to start all communication from scratch.

8. Don’t repeat known information: In the current situation it isn’t helpful to bulk your communication strategy out with content discussing what the coronavirus is, how it is transmitted, infection rates and treatment. This is not the role of a fund manager or financial adviser—it just clouds your core messages.

9. An opportunity to amplify your message in the media: Honner is currently receiving inquiries from media looking for support from fund managers to provide commentary and insight on the situation. There is an opportunity for fund managers to proactively provide their insights to the media, particularly if you respond in a timely way to key market events. The media are hungry for your perspective. Don’t be shy—write down a few points and work with your communication consultant to get them in front of key journalists.

10. Leverage the power of your employees’ social networks: When you push out content, encourage your employees to share this content via their own personal LinkedIn profiles to further amplify your message and content. To retain control of the message we recommend providing employees with a compliance approved key message to introduce the content pieces.