I’ve decided to start this blogpost with a cranky headline. Much like Dr Bruce Banner before turning into The Hulk in the first Avengers movie, I will also let you in on my secret: despite not showing it, I am always angry… whenever I hear someone call news coverage “a great outcome”. It’s not… And calling it that can cause us to drift away from our objectives.

Don’t get me wrong, favourable news coverage does make me happy, especially whenever my team and I have been working hard to attain this. My point is the outcome of our PR strategy and activities – the actual communication outcome – is something that can’t be seen in any news coverage analysis. Positive coverage does not automatically mean positive reputation. That is a far-fetched assumption, especially if we’re only looking at earned media to asses reputation. To understand the outcomes of our campaigns, we must look beyond.

To begin with, communication happens not when news is published or advertising is displayed, but when our target market reads or listens to what we say or is said about us, and when they understand, accept or respond to the stories that involve us. Likewise, it also happens when we listen, understand, accept or respond to the messages from our target audience – that is, if we accept the notion of stakeholder capitalism.

But even if we are still passionately attached to the old paradigm of shareholder capitalism, where the sole role of PR is to persuade a target market to think or act in a desired way about a brand or product, the real communication outcome can mostly be observed through market research, using techniques such as surveys, focus groups and in-depth interviews, among others, not by running news coverage analyses and making fancy-looking graphs with the clips achieved.

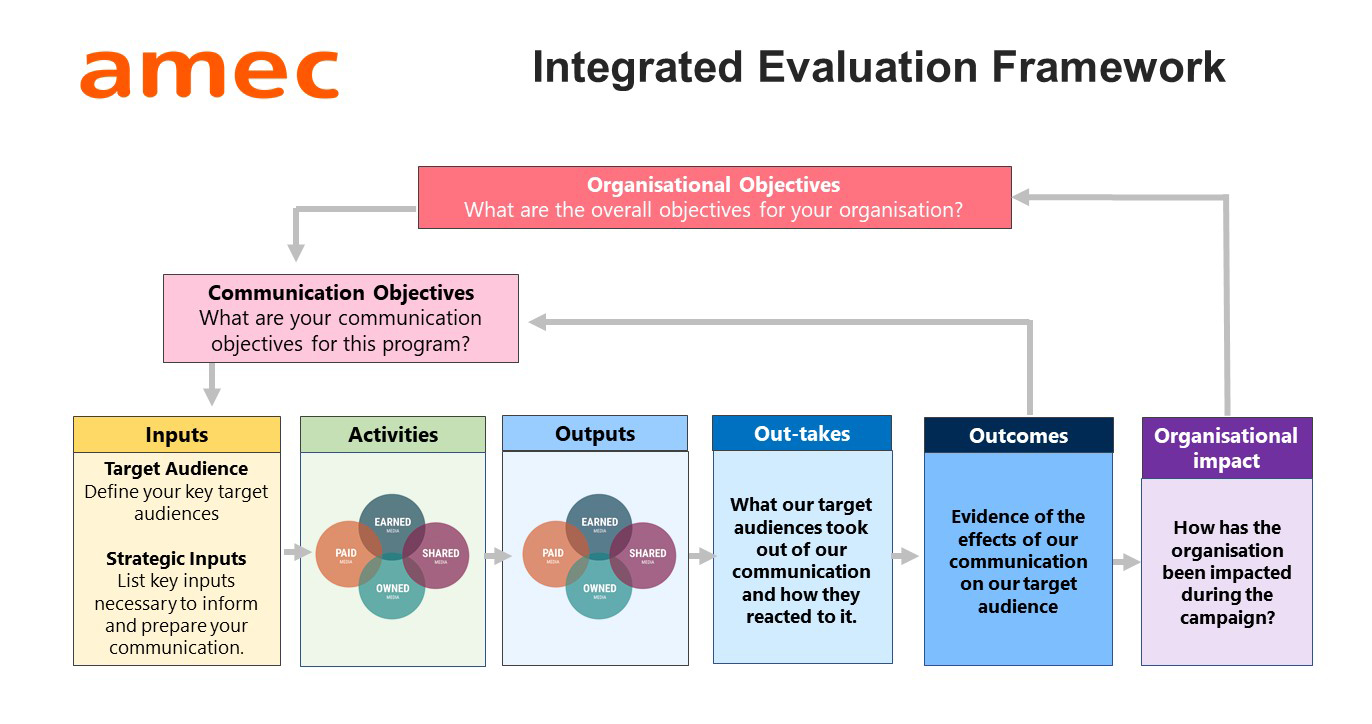

This approach to measurement and evaluation has been proposed by the International Association for Measurement and Evaluation of Communication (AMEC) since the publication of the Barcelona Principles in 2010 (updated in 2015), and more recently, with the appearance in 2016 of the Integrated Communications Measurement Framework. The framework distinguishes between Objectives (SMART ones), Output (our story and messages communicated to our target audience), Out-takes (immediate reaction of our audience and information recall of a story, organisation or product) and Outcomes (effects in the attitudes, opinion and behaviour of our audience towards a story, organisation or product). At least a version of this is worth considering for structuring an integrated communications program or campaign.

Let’s go back for a minute to the fancy-looking graphs. To clarify, these graphs with news coverage segmented by prominence, favourability, audience, reach, themes, message cut-through, visual impact, etc. do have a role, an important one even. They help us to stir a program in different directions if needed, and they might even be useful for generating KPIs. But if we’re aiming to have in place a sound strategy across all media with measurable communication objectives that can aid the organisation’s business goals, it’s critical to consider news coverage for what it is – which is, output, not outcome.

It’s also important to note for anyone that made it this far down in this cranky blogpost that a clear taxonomy of concepts is not an end in itself. The ultimate benefit of referring to news coverage for what it is is that it allows us to look at the big picture, which is first and foremost, our communication objectives. What is it that we’re trying to do? Is it increasing brand awareness among a specified segment of the market from 10% to 15% in the next 12 months? Is it to replace A for B as the most associated brand attribute, assuming A will help the organisation to increase leads or conversions? Is it to decrease from 20% to 15% the percentage of people who are currently not considering buying our products in the near future? Is it to lower from 60% to 20% in three years the amount of people with a specific misperception about our organisation and its services? All these are examples of the right questions to ask whenever communicational objectives are discussed and agreed on in writing.

Only once these communication objectives have been achieved, can we truly say that our integrated program across all media teams has jointly achieved a “very good outcome”.

Author: admHonWpAdm

Communication strategies to support nervous investors: a guide for fund managers

While we can’t predict the future, Honner has more than 20 years of experience in building communication strategies and supporting asset management firms, financial advisers and individual investors during volatile times. This included the GFC, September 11 attacks and dot com bubble.

Today we are facing a new crisis. The coronavirus is currently spreading, bringing with it panic and anxiety for investors of all types around the globe. At the time of publishing this article, the weekly fall in the Dow Jones Industrial Average ranks within the top 15 in its 124-year history and it was the worst week for stocks since the global financial crisis.

In an industry where it is difficult to differentiate your offering, quality, timely communications and the way you deliver it can clearly distinguish your brand. Here we’ve identified some key communication strategies that can make your brand stand out during this period of uncertainty:

1. Be visible, open and honest: One of the key aspects we’ve learnt from periods like this is that people understand and accept that markets can be volatile but they won’t forgive a lack of support, a lack of transparency, and slick cliché messages that aren’t helpful (similar to the lesson Scott Morrison learnt during the recent bushfire crisis). In difficult moments such as this, companies need to prioritise timely communications that are transparent and provide valuable insight to employees, financial advisers, investors and the media.

2. Consider building a communication response team: If the crisis moves from days to weeks, fund managers should consider creating a core communication team that has responsibility for managing the communication process. This should be a small nimble team that includes representation from across the business (from your marketing, client service, sales, and investment teams and also your communication agency). The team should be empowered to mobilise and respond quickly, and to act as a contact point for the entire firm, while also being responsible for building and maintaining a long term communication plan that evolves with the unfolding situation.

3. Pick a spokesperson: Consider picking a spokesperson to be the voice of the firm during the crisis—to show consistency for the brand. This should be someone who can connect with people easily, is sincere and transparent during interviews, and has experienced extensive media training.

4. Support financial advisers to do their jobs: When a market correction hits, the first place many investors turn is to their financial advisor. This can be a stressful time for a financial adviser. It is also the ideal time for a fund manager to step up to support financial advisers with valuable content these advisers can use en masse with their own clients—to help calm their clients and provide emotional support.

5. Create content that adds value, is visual and uses historical data to tell the story: Try and avoid long copy articles. Focus on visual content that ideally draws on historical data and supports your key supporting messages. Don’t focus on what has occurred with the market. Rather, try to highlight your current portfolio positioning. Some examples of key content pieces doing this well include:

- The cycle of market emotions image from Russell Investments is a powerful snapshot of how investors typically make the wrong decisions at the wrong time. Russell Investments’ downside management toolkit on their website is also a good example for other fund managers to follow.

- The market volatility section of Franklin Templeton website.

- Fidelity has created strategies for uncertain times, a guide for investors on “What to consider when the market gets volatile”. Most of the largest asset managers in the world have still to reflect the market correction on their public facing sites, which is disappointing.

- Vanguard has an interactive chart that allows you to build your own customised version of the index chart with 30 years of investment performance of major asset classes. (They just need to update it to reflect recent correction.)

- Capital Group created an illustration using historical data highlighting the dangers of investors sitting on the sidelines and the benefits of investing – even by selecting the worst day each year to invest.

- Schroders has produced a strong piece: coronavirus: the investment impact in seven charts.

- Investors Mutual have produced a piece that details how does this impact iml’s portfolios and what are we doing about it?

6. Create a coronavirus content hub for investors: Too much content can become overwhelming and become quickly out of date during such a dynamic period. Consider creating a specialist area on your website that houses all content related to the coronavirus market event. Too often firms distribute a lot of communications and content pieces—but as the situation unfolds and changes it can become confusing for your clients. The hub can also be a great resource for employees to ensure they are accessing the latest information. See the examples above of fund managers that are nimble and have websites that reflect the market correction.

7. Repurpose old content: Look at some of your previous material on investor tips and see what can be quickly updated and repurposed for this situation. You may not need to start all communication from scratch.

8. Don’t repeat known information: In the current situation it isn’t helpful to bulk your communication strategy out with content discussing what the coronavirus is, how it is transmitted, infection rates and treatment. This is not the role of a fund manager or financial adviser—it just clouds your core messages.

9. An opportunity to amplify your message in the media: Honner is currently receiving inquiries from media looking for support from fund managers to provide commentary and insight on the situation. There is an opportunity for fund managers to proactively provide their insights to the media, particularly if you respond in a timely way to key market events. The media are hungry for your perspective. Don’t be shy—write down a few points and work with your communication consultant to get them in front of key journalists.

10. Leverage the power of your employees’ social networks: When you push out content, encourage your employees to share this content via their own personal LinkedIn profiles to further amplify your message and content. To retain control of the message we recommend providing employees with a compliance approved key message to introduce the content pieces.

Investment Management in Australia: Where are the women?

Over the past 25 years working in Australia’s investment and super industry, I’ve come across a lot of skilled investors. It’s been a privilege to work with a wide spectrum of investment teams from across Australia and the world’s leading asset managers.

But in that 25 years of interviewing or providing communications for asset managers—and supporting the media programs for literally hundreds of local and global investment executives—I can count on two hands the number of women in senior investment roles I’ve encountered.

Last year Honner joined a growing movement to tackle the lack of diversity in Australia’s substantial investment industry by providing pro-bono support to diversity initiative Future IM/Pact.

Recently I spoke with diversity champion and former Honner teammate Yolanda Beattie. Yolanda founded and leads Future IM/Pact, which is starting from the grass roots: building a passion for investing among young women, and matching those women with potential employers in the industry. The goal is to achieve an equal number of women and men in junior analyst roles by 2023.

Yolanda, how did this great initiative come about?

About four years ago, when I was leading Mercer’s diversity and inclusion consulting practice, I led a research project in partnership with funds managers and super funds investigating why there are so few women in investment roles. At the time it was a really obvious problem that had CIOs and CEOs scratching their head in wonder and throwing their hands up in frustration. If they had 100 applicants for an analyst role, they were lucky if 10 women applied. They were desperate to get more women into their teams but just couldn’t find the talent. I was determined to solve the puzzle.

We surveyed and interviewed hundreds of women and men in the industry and at university to figure out what was going on and we boiled it down to five big issues.

The first problem to solve was a lack of awareness about the profession. Uni students didn’t know about investment management and, if they did, they were tainted by Hollywood stereotypes and high-profile scandals. Worse still, female finance students were almost 50% less likely than their male counterparts to consider a career in investment management. Not knowing enough about the industry and opportunities, and a sense they wouldn’t fit in, were among the top reasons cited.

So a group of the original industry partners and a few extras joined forces to build a campaign to help young women learn about the impact they can have as an investor.

You’re building a future pipeline of talented women for the investment industry. Tell us a bit more about how you do that.

Our strategy is to inspire super smart, critical and creative thinkers to learn more about investment management, and then provide them with the experience, networks and career pathways to get a foot in the door. We do that with social media campaigns, networking events, investment competitions and paid intern opportunities. This year we’re also launching a virtual intern program and mentoring circles to give students an inside view of what it’s like to work in an investments team.

Why is it important to have more diverse investment teams?

In a world where there’s more to know about everything, bringing different perspectives to the decision-making table is essential for overcoming unavoidable blind spots and biases. Investment management is one of those professions where this matters hugely to outcomes. Women tend to bring a different perspective than men for reasons that are biological and socially conditioned.

Bringing women, and other visible diversity like cultural diversity, into white, male dominated teams also has a massive impact on behaviours. Research shows diversity prompts more thoughtful decision making: fewer assumptions are made, more points are considered and there’s more turn taking around the table.

I could rattle off stats about the correlation between gender diversity and investment returns or total shareholder returns but the truth is a sceptical mind can unpick those stats because most studies don’t adequately control for other factors. And when you do tighten those controls, you find other factors matter more—namely educational and experience diversity and team behaviours.

But when you speak to any investment leader who has worked in nearly all male teams and those that have more gender diverse teams, they will tell you it feels different. Egos are more in check and discussions are more considered.

What it takes to attract and keep great women investors are the same attitudes and behaviours known to improve group dynamics and team performance. Alliance Bernstein did an excellent meta study on this, which I boil down to four factors that inhibit effective problem solving within groups: excessive hierarchy; dominant majority and its impact on group polarisation; conflict avoidance; and emotional insensitivity. Get that stuff right and you not only retain minority talent but you make better decisions.

The project is now in its second year, what success have you had so far?

We’re killing it! Thanks to our amazing partners, supportive university societies and my excellent team, we beat our key performance indicators for last year and are on track for an even bigger 2020.

The best measure of success so far is our investment competition where gender-balanced university teams of four competed to win a paid summer internship. Close to 130 women registered for the competition and an all-female team ended up winning. Each member of this team hadn’t heard of investment management before Future IM/Pact and they met at a Future IM/Pact event.

Our industry partners like Cbus, Nikko Asset Management and Yarra Capital Management have been thrilled with their interns who are delivering more value than they’re taking.

What are some of the other barriers to diversity you found in your original research? What are the other opportunities for the industry?

Arguably the biggest issue is keeping the great women already in investment teams. We found women were 30% less likely than men to be promoted and 50% more likely to leave at the senior analyst level. Culture, bias and a lack of flexible working are the main reasons for this disparity.

But the opportunity is way bigger than gender. Ultimately this is a very human story. The best investors are excellent at marshalling diverse perspectives and creating an environment where people can do their best work. The factors I mention above from the Alliance Bernstein research boil down to self-awareness and strong interpersonal relationships. And when you get under the hood of that you find many other juicy topics—knowing how we get triggered, managing negative thought patterns, gratitude and compassion, the power of mental models for improving decision making, to name a few.

In a game where teamwork and decision-making drives tangible performance outcomes, doubling down on what we need as humans to thrive is the next big opportunity.

***

About Future IM/Pact

Future IM/Pact is an industry initiative aimed at attracting more diverse talent into the investment teams of fund managers, super funds and industry participants. The project was launched in July 2018 with founding partners Mercer, AustralianSuper, HESTA, QIC, Cbus Super, NAB Asset Management, Pendal, Magellan and Wavestone. Since then, Nikko Asset Management, Fidelity International, Yarra Capital Management, Challenger Limited, Macquarie Securities, Vinva Investment Management, Schroders, Cooper Investments and Perpetual have joined the project. More information can be found at www.future-impact.com.au

If you would like to be a part of Future IM/Pact contact Yolanda Beattie at yolanda@yoandco.com.au

Insights from Canada (2019 Exchange) – The changing face of communications

Communications is a rapidly changing field and one that’s increasingly globalized. Honner’s global network of partner communications firms ensures we keep abreast of the latest thinking and techniques so that we can implement them for our clients.

As I mentioned in my last blog, I was recently privileged to experience an exchange program working at Argyle Public Relationships – one of Canada’s largest management-owned communications firms and recently named by the Globe and Mail as one of the country’s fastest growing companies.

The exchange with Argyle was a chance for me to step back from Australian financial services communications, a world I have been working in for over three years, and to learn what is best practice in the PR industry in Canada with an agency whose clients range from Facebook to the Ontario Science Centre.

It was also particularly a good time for me to take this trip while we’re continuing to expand our service lines at Honner, into influencer marketing, investor relations and more, and to see how other agencies have also built more integrated campaigns, an area that Argyle specialises in.

In this blog, I explore Argyle’s approach to communications – featuring some powerful and unique tactics that have led them to this success.

Media is only part of the solution

At Argyle, PR and communications are highly integrated, with media only being a part of the solution. PR is a lot more than media relations and Argyle clients do not see their PR consultants as ‘one trick ponies’.

A typical Argyle strategy would include a wide range of tactics such as: media; social and digital; strategic partnerships with researchers or think tanks; association and community engagement; influencers; media buying; creative advertising (banners, display ads storyboards, infographics, videos), content marketing; events; and websites.

In Australia, Honner too has been on a journey in recent years to expand our offering, building on our strong background in financial services PR to now utilise a much broader range of tools to achieve our clients’ strategic goals, including investor relations, marketing solutions, digital communications, and content marketing.

So, it was great to have first-hand experience of working with an agency that’s pushing the boundaries of communications, including utilising new technologies to shake up campaigns, especially in the consumer space.

Particularly in digital, Argyle are doing some cool things such as touch screen engagements using kiosks, digital billboards, virtual / augmented reality pop ups, sensory images, interactive charts, Snapchat filters and Instagram stickers for their clients.

Influencer engagement is mainstream

Argyle helps clients garner unconditional support from influencers. Similar to Honner’s media roundtable events, Argyle launches the products and services of their consumer clients directly to influencers.

The success mantra is to work around their timings (most influencers have full-time jobs), select an ‘Insta-friendly’ venue, use custom hashtags and pitch it right: What’s in it for them? How can they engage their followers better through this content?

Often, Argyle also encourages including the influencer voice in client media releases or media engagements, where appropriate, to add an extra layer of third-party credibility. It works.

At Honner, we are exploring how we more effectively engage influencers and opinion leaders across the financial services sector to help clients tell their story in different ways to new audiences.

In-depth audience analysis comes first

Audience analysis is sacrosanct for any strategy build, and Argyle’s approach is very impressive.

A typical audience mapping includes identifying who is most critical in directly helping clients achieve their top three objectives and what their sweet spots are: What keeps them up at night? Who influences them? Who belongs in their circle of trust? What are the best ways of reaching them?

Argyle does this by developing detailed illustrative personas listing their risk tolerance, motivation, pain points, influencers and media habits. This exercise helps them to answering the above questions and hit the bull’s eye when it comes to understanding the psyche of their audience.

An audience intelligence and social listening platform, Pulsar, is what they swear by.

Secondment in client offices

Argyle has dedicated consultants working on their single largest client, Facebook Canada, which also involves spending a couple of days working out of client offices each week.

This is a common concept at the agency and very well received by clients. It is a classic example of how Argyle consultants work as an extension of their clients’ marketing and PR teams and are able to work seamlessly towards achieving their clients’ business and communication goals.

Overall, it was a fantastic experience to be able to spend some time with the exceptional team at Argyle, learn more about Canadian culture and also share my insights on the Australian business and media landscape with the team.

Lastly, my highlight: amid a fully packed week, I managed to pay a sneaky visit to Niagara Falls for my Instagram. A major tick off the bucket list!

Insights from Canada (2019 Exchange) – Far flung markets with much in common

When you become deeply involved in one industry, sometimes it pays to take a step back. It can be beneficial to look into a new market, or another industry, and adopt the insights into your own world.

That’s exactly what I did during my agency exchange to Argyle Public Relationships in Toronto late last year, and I will be grateful to Honner for giving me this opportunity, and to Argyle for their hospitality.

The opportunity to work with this award-winning agency was possible due to the strong relationships that Honner has formed around the globe.

These relationships allow Honner to deliver cross-border programs, create highly integrated programs for clients, and offer international experience to its staff. By participating in international exchange programs, employees of Honner play a role in bringing insights back on the latest communications techniques from around the world.

Firstly, let’s briefly compare the financial services markets of the two countries, then in my next blog I’ll share some insights from the Argyle approach to communications.

Same-same but different

Despite being located in two distant corners of the world, there are remarkable similarities between the Canadian and Australian markets.

Banks

The Canadian banking industry follows a typical oligopolistic structure like the Australian banks. ‘Big Five’ is the name colloquially given to the five largest banks that dominate more than 75% of the nation’s banking assets: Bank of Montreal (BMO), Scotiabank, Canadian Imperial Bank of Commerce (CBIC), Royal Bank of Canada (RBC) and Toronto-Dominion Bank (TD).

When considering how Canadians feel about their banks, one phrase comes to mind: love-hate (Rings a bell?). Canadians love owning bank stocks (some also hold 100% of their portfolio in banks!) as they are among the most powerful institutions in the country paying attractive yields, but hate them for their aggressive sales tactics, annoying ATM charges and petty fees – all of which indicate the staggering amount of money they make.

However, the Royal Commission into Banking and Currency in Canada happened in 1933 and there are no signs of it happening again. Why? Research shows that Canadians banks are better with corporate governance. Boards of Canadian banks are larger, more experienced, paid 40% less than Australian directors and are more diverse. In short, Canadian banks’ governance practices are more “mature” so despite a few scandals, they’re well shielded from any potential scrutiny.

Despite this regulatory inertia, there is pressure on the banks from increased competition as fintech adoption picks up and innovative products catering to specific consumer needs hit the market.

Pension industry

There are also a number of similarities between our pension systems. Both countries are focused on a pension policy of compulsory savings and their asset pools are comparable in size. Australia’s $2.1 trillion superannuation system edged ahead of the Canadian pension scheme to rank as the world’s fourth-largest pool of retirement savings not too long ago.

However, Canada Pension Plan (CPP) is compulsory for all Canadians (minus Quebec residents), unlike Australia where you can either choose your super fund or must invest in the default fund of the industry you work in.

Media

On the media front, there are fewer trade publications in Canada than in Australia after a period of consolidation in the industry. Among the major newspapers, Globe and Mail, Financial Post and Toronto Star are the holy grail for all business brands, similar to the dominance of the Australian Financial Review, The Australian, The Daily Telegraph and Sydney Morning Herald this side. With media desks shrinking, pre-briefs are preferred over press release distribution, and the demand for exclusive stories is on the rise.

It would be unfair to conclude one is better than the other. But there is great opportunity for both countries to spend more time comparing notes, given the commonalities. One thing that really stood out to me is that Canadian financial companies are constantly connecting and getting involved with local communities whether through PR / marketing campaigns or through direct sponsorships and partnerships.

Thanks to the relationship we have cultivated with Argyle PR through this exchange, we are well positioned to embed the Canadian best practice into ours, to help our clients communicate their messages more effectively in the new decade.

Look out for my next blog on communications strategy insights from Toronto and the ‘Argyle way’ of doing things.

Why diverse voices build better brands

It is a well-known fact that women hold crucial purchasing power in their households, with research showing women drive 70-80% of all consumer spending decisions, through a combination of their buying power and influence. Globally, female consumer spending is estimated at around US$40 trillion.

In the media, however, women are decidedly under-represented. According to United for News, a multi-stakeholder coalition led by international non-profit Internews, only 19% of experts quoted in the news are women – a figure that has changed very little in the past two decades.

Even in the influencer landscape, the numbers are not much better. Of the most followed YouTube channels, all of the top 10 are fronted by men and only 23 of the top 100 are led by women. This shows that the digital space is currently mirroring trends we see offline.

Both women and men want to identify with the faces being used in media and advertising and it is clear that those businesses that do not adequately represent their customer base risk alienating them and hurting the bottom line.

Amplifying female voices

Positively, there are currently a number of initiatives underway to amplify female voices in the media.

United for News is currently working to increase both demand and supply of female voices in news. On the demand side, it is providing best practices and assistance for newsrooms to source more female subject matter experts, and on the supply side, it is providing women with the support and resources to step forward.

In 2019, United for News ran a pilot program in Canada, Ukraine and Iraq, with a view to rolling out its program more broadly in the coming years.

News outlets are also seizing on the opportunity to broaden the range of voices being heard in the media today.

One of these is Bloomberg, which is seeking to build a definitive global database of women newsmakers in business and finance through its New Voices initiative. The program includes media training for women and other diverse executives who are under-represented on its broadcast airwaves.

In the UK, for more than two years journalists and producers across the BBC have been tackling the gender representation issue by targeting a goal of 50:50 representation every month.

The broadcaster’s nightly prime time news program ‘Outside Source’ started the effort in 2017 and took its representation of on-air contributors from 39% women to 50% within four months. Today more than 500 BBC shows have joined the project, highlighting the difference a sustained effort can make.

Takeouts for businesses

While the efforts of news outlets to increase the representation of women in the media is making some inroads, there is still more work to do on the corporate side.

According to Kantar’s What Women Want research, despite an increased focus on equality driven by movements like #MeToo, major brands are still not effectively acknowledging women’s priorities, or communicating with women in an empowering manner.

However, those that do successfully promote gender-balanced marketing are 4% healthier than male-skewed brands and 6% healthier than strongly male-skewed brands.

The female demographic offers huge opportunity for marketers, and brands that understand what women want are in a better position to capitalise.

Businesses should therefore avoid using stereotypes and instead use data and analytics to tap into the needs of their audiences.

Women are also more likely to respond to media spokespeople they feel are like them. All businesses should therefore take steps to ensure diversity in the voices they are offering to the media. For executives who are still building their media interview skills, Honner offers tailored media training to build confidence and know-how about the process.

There is no one-size-fits-all for connecting with female audiences. However, for businesses that want to truly understand their target market, one of the best places to start is to acknowledge that there are differences between men and women, and shape PR and marketing efforts on that basis.

The 5 R’s of your new year content marketing audit: retain, refresh, retire, relaunch and repurpose

The beginning of any new year provides the opportunity to invest the time to undertake a content marketing audit. You’ve already spent a lot of time creating numerous pieces of content and now is an opportunity to step back and look at the big picture.

The Honner infographic Turning Content Marketing into Conversations details the key steps to executing a winning content marketing program. The content audit represents the last stage of this continuous process and provides the opportunity to retire old content, relaunch some of your best content and identify gaps in your overall content marketing efforts.

The idea of a content audit might sound onerous. But you need to remember how much effort it often takes to write one new piece of content. Investing time in a content audit not only provides an opportunity to improve your future content marketing efforts but can also provide the opportunity to relaunch existing quality content pieces with minimal effort.

Here are some simple steps to follow when conducting a content marketing audit:

First – gather all the data in your content audit spreadsheet

The first step is to set up a simple content spreadsheet. This allows you filter all the content by topic, target audience, date published, format (blog, video, infographic, e-book, image etc), customer journey stage (i.e. awareness, decision) etc. This should also allow you to rank all of your content based on performance metrics or customer engagement.

Second – allocate your existing content into one of these five buckets

Once you’ve got all your content in the spreadsheet, start to allocate each content piece into one of these five categories.

- Bucket 1 = Retain: Identify your evergreen content that still has long-lasting value.

- Bucket 2 = Refresh: Uncover outdated content and update it.

- Bucket 3 = Retire: Look for content that has limited engagement or is just plain irrelevant now – and retire it

- Bucket 4 = Relaunch: Discover the star content and promote it again. Assess your content metrics and identify your top 10 pieces based on customer engagement. Consider updating these content pieces and relaunching the piece again.

- Bucket 5 = Repurpose: You can also take your star content and package it into different formats. You also might want to consider turning these content pieces into videos or infographics or even a podcast. Also consider taking a series of content pieces or blogs and packaging them together into an eBook that could launched and promoted via paid media.

Additional communication strategies to consider during the audit process

- Look for content gaps in your content spreadsheet. The reviews should not only provide you with a view of what you have – but also what you don’t have. Are there areas of strategic importance to the business that have been neglected during the content marketing process?

- Publish a blog on your most read pieces of the year. This will drive more traffic to these key pieces and highlight the strength of your content marketing efforts.

- Identify technical flaws and find broken links that may be impacting your customer experience.

- Boost SEO: Find ways to improve some SEO such as ensuring you are using the right keywords or proper sub-headings tags.

- Spy on your competitors: Also consider tracking the performance of your competitors’ content for additional fresh ideas. Look at how they optimise their content and how many keywords they used.

- Use the insights to inform your future content strategy: Capture all the insights from this audit process, taking into account your successes and failures. It is probably true that 20% of your content is generating 80% of the results. It makes sense to learn what is performing and feed these insights into your strategic content plan.

Want help conducting a Content Marketing Audit? If you would like help or support conducting Content Marketing Audit please contact Honner’s Head of Marketing, Craig Morris on craig@honner.com.au

What can financial institutions learn from fintechs?

It’s safe to say that the Australian banking sector is at a huge crossroads. Traditional banking institutions have run the gauntlet with the Royal Commission and are now picking up the pieces.

At the same time, new and nimble fintechs are popping up around them, with bright and flashy logos and branding, suddenly becoming attractive to consumers because of what they can offer and their fresh approach.

There has been a wealth of challenger banks breaking into the Australian market over the last two years. Brands like Xinja, 86 400, and Up Bank, are all gaining traction with consumers.

So, what exactly is it that they’re offering that consumers can’t get enough of?

It all comes back to the way these businesses are set up. These fintechs focus on technology-led banking, not banking-led technology.

They only operate digitally. They push hard on the things that ‘matter to millennials’, like no fees on overseas purchases. They offer complete transparency on which vendors you have paid through an auto-detect, allowing for more effective budgeting.

Perhaps more importantly, they can talk to consumers in plain, jargon-free language. They seem to make the banking process simple and offer value above and beyond what consumers perceive to come from the incumbent banking giants.

What do we want?

According to a KPMG report, by 2030, millennials will comprise 75% of the workforce. The report also states that 70% of consumers are looking to consolidate their financial relationships, to have them all, or most of them, with one provider.

A changing workforce coupled with a change in how consumers want to organise their lives means that financial institutions need to start working on how they can meet the needs of this shifting demographic.

To say that it is the end for the traditional banking institutions would be naïve. They are far from out of the game. They still have appeal with consumers, and still resonate well with certain demographics. But as technology continues to evolve, they need to keep pace with the fintechs.

So how can they do this?

- Don’t make assumptions about your audience

Assuming that people under 40 live off avocados, and that people in their 50s like sudoku puzzles and long walks on the beach, might be a little off. Making incorrect sweeping assumptions about your audience may alienate them, so try to keep stereotypes to a minimum when you’re talking about your customer base, or potential customer base.

- Embrace social media to communicate

Most businesses and brands are active on social channels, but there’s still some reluctance to actually engage with people through it. We all know that engaging with customers on Facebook as a platform can very quickly turn into a mud-slinging contest, but for consumers, knowing that they have a way to reach the brand is half the battle. How they are communicated with on their issues is the sticking point.

- Value your customers

Ultimately, consumers want to feel valued by their bank. We don’t want to feel like we’re being ripped off, like we’re being taken advantage of by our bank because we’re being loyal and sticking around. Offer us competitive products, help us save money, and make us feel like we’ll be missing out if we move on to another institution.

At the end of the day, it’s not just how you reach out to your customers, but how you keep them.

Traditional financial institutions won’t stop the fintechs growing or sweeping up unhappy consumers. Instead they can look to how they interact with and treat their existing customers. As much as we love technology and things being made easy for us, we also like trusted and historical brands – there may well be room for both.

It’s a wrap – Honner’s quarterly media roundup (Q419)

What’s news?

Media empires unite over press freedom

In a rare moment of unity, Australia’s biggest media companies came together to campaign for freedom of the press and protections for whistle blowers. A coalition of news organisations including Nine, ABC, News Corp, Seven West Media, Ten and Bauer joined the campaign, which spread across the nation in print, digital, radio and TV.

National mastheads including The Australian and The Financial Review ran special covers with heavily “redacted” text to argue the media is subject to a regime of intense government secrecy. As part of the campaign, Your Right to Know, a TV commercial was also produced to raise awareness about the lack of transparency from governments.

The coalition is pushing for stronger protections for media freedom after years of perceived deterioration that the outlets say has left journalists restricted in their ability to hold the powerful to account. The campaign follows two police raids, on the home of News Corp journalist Annika Smethurst and the ABC’s Sydney headquarters, last year, which drove the issue of media freedom to the forefront of public consciousness.

Australia’s press freedom protections are weaker than other Western democracies. Unlike the US, which enshrines free speech and a free press in its constitution, Australia has no strong legal protection for journalism and free expression. Reporters Without Borders ranked Australia as 21st in the world for press freedom in 2019, down two places compared to last year, warning that investigative journalism is under threat from “draconian” laws.

Your Right to Know coalition’s demands include better protections for whistleblowers, exemptions for journalists from laws that would put them in jail for doing their jobs, and the right to contest the application for warrants for journalists and media organisations.

Rainmaker acquires Industry Moves

Rainmaker Group, published of the Financial Standard and Money magazine, has added to its growing media portfolio with the acquisition of executive recruitment and leadership title Industry Moves. The move is the latest in a round of acquisitions for Rainmaker which in September purchased The Sustainability Report and Audacious Investing.

Crikey launches new investigative unit

Crikey’s new investigative unit INQ launched with a series of stories including revelations of partisan stacking of the Administrative Appeals Tribunal and an exposé of the debt-collection industry chasing billions from people on government benefits.

Bauer Media buys Pacific Magazines, catches the eye of private equity

The media decks continue to be shuffled with Woman’s Day publisher Bauer Media buying its long-time rival Pacific Magazines, home of the New Idea, from Seven West Media for $40 million. It seems someone likes the look of the combined entity with the Australian Financial Review reporting that Mercury Capital is in advanced talks to buy Bauer for $150 million.

Warburton makes first acquisition as Seven CEO with Prime Media deal

It’s out with the old, in with the new at Seven West Media which a few days earlier, agreed to buy regional broadcaster Prime Media Group  the first acquisition by the group since James Warburton came on board as chief executive announcing a $444 million loss. Warburton says he remains on the hunt for deals as he works to turn the group around.

the first acquisition by the group since James Warburton came on board as chief executive announcing a $444 million loss. Warburton says he remains on the hunt for deals as he works to turn the group around.

Nine lowers forecasts, points finger at lending restrictions

The weak advertising market caught up with the Nine Network, which told shareholders at its annual general meeting that full year earnings will be in the low single digits versus 10% previously forecast. The profit warning comes after Nine completed its acquisition of Macquarie Media and began integrating the AM radio newsrooms it acquired in the deal in an effort cut costs.

Report recommends media rules shakeup, after lobbying by regional owners

A Department of Communications commissioned report has recommended the wind back of media laws, which could allow for a wave of mergers and acquisitions in regional TV, radio and print. The Australian Financial Review reports that the recommendations include the removal of the one-market rule, which presents TV broadcasters from operating more than one TV license in a market. The recommendations follow lobbying by regional media owners cautioning squeezed earnings could force more job cuts.

Thomson-Reuters rebuffs suitors

Thomson-Reuters has rebuffed takeover interest in its newswire from suitors including KKR-backed German media business Axel Springer and a group of individuals including former Reuters editor-in-chief and ITN boss Mark Wood, according to a report in the Financial Times. Instead, the company is backing deal-making executive Michael Friedenberg, president of Reuters News, to give a jolt to the business that reported organic growth of just 3% in the third quarter.

Facebook unveils new logo, launches news service

Facebook unveiled a new logo and branding to distinguish the corporation from its social network with the same name, and launched a test of its news service Facebook News for select users.

Advertisers abandon Alan Jones

Alan Jones’s radio show has lost hundreds of advertisers since his comments about New Zealand PM Jacinda Ardern.

ABC flags more job losses

Budget cuts are about to impact the ABC boss David Anderson warning there will be job losses due to reduce funding.

Insights & Opinion

‘Deepfakes’ for audio? Experts are worried, but podcasters are excited, writes Nick Bonyhady of the Sydney Morning Herald.

Youth broadcaster JJJ is undergoing its most significant shake-up in years as high-profile hosts may way for the new guard, writes Meg Watson in The Guardian.

With federal and state attorneys general set to discuss a major overhaul to Australia’s defamation laws, Josh Taylor and Paul Karp at The Guardian discuss what the proposed changes could mean.

Quotable Quotes

“The changes have been constant and meteoric.” – Media entrepreneur Eric Beecher on the “maelstrom” that has hit Australian journalism.

“I wouldn’t expect a huge effect in the short term, but ultimately when you’re selling newspapers … the ability to report is very important.” – Nine Chairman Peter Costello warning there could be a financial impact to the media sector if the government doesn’t safeguard press freedoms.

“This decision begins to change the content equation.” – News Corp Chief Executive Robert Thomson arguing the relationship between digital giants and traditional media is beginning to shift, after Facebook agreed to pay a significant premium for Wall Street Journal content.

“The category is in crisis.” – Australian Community Media Executive Chairman Antony Catalano on the state of regional media in Australia.

“This is a pretty sad thing. And the greatest casualty has been, and will continue to be, the 6pm news,” – Prime Chairman John Hartigan arguing that without government intervention, regional news ‘will fail’.

“If you are old and white and wealthy and you live in Mosman, the ABC does a lot for you. But if you are not those things and you live in the outer suburbs of our cities the ABC is much, much less relevant to you on a daily basis.” – ABC director of news Gavin Morris admitting the public broadcaster has a “perspective” problem that has seen it focus on the rich, white and wealthy.

“We could’ve sold a long time ago if we wanted to sell.” – Seven West Media Chairman Kerry Stokes denying speculation recent deals, including the sale of Pacific Magazines and the merger with Prime Media, are part of a plan to boost the company’s balance sheet in preparation for a sale or merger.

Movers & Shakers

Charlotte Grieve is now at The Age, covering business. Charlotte formerly worked at The Citizen as a cadet journalist.

Laura Chung is now working at The Sydney Morning Herald as a journalist, after previously working at Nine Entertainment as a finance producer.

Eliot Hastie is now at News.com.au as a business reporter. He was previously at Momentum Media, where he wrote across ifa, Investor Daily, Fintech Business and Wellness Daily.

James Hall is also at News.com.au as a finance reporter, having previously worked at Australian Associated Press where he covered a broad range of desks including state politics in South Australia and the stock market from Sydney.

Mathew Dunckley has taken up the role of Digital Editor for The Age, having previously worked in the role of Business Editor at The Sydney Morning Herald and The Age.

Journalist and presenter Jan Fran is the new host of The Pineapple Project podcast.

Tharshini Ashokan is now at Self-Managed Super as a cadet journalist.

Sybilla Gross is now at Bloomberg sitting in the cross-asset team.

Kristi Cheng has left Financial Standard.

Gerard Cockburn has moved to The Australian as online business reporter. He was previously writing for The Courier Mail.

Glenda Korporaal will relocate to The Australian’s Sydney office to continue her role as a senior writer on business and corporate Australia.

Sarah Jones is now at Investment Magazine as Deputy Editor. She was previously in London for 12 years writing for Bloomberg.

Laura Daquino and Ahron Young are both now at Ticker TV—Laura as a business journalist, Ahron as presenter.

Can financial services firms save the world?

In recent weeks 16-year-old Swedish activist Greta Thunberg has ignited the global debate on climate change, taking a zero-carbon voyage to America and delivering an impassioned speech to world leaders at the UN climate summit in New York on September 23.

Media coverage in the weeks following shows Thunberg has become a figure who is almost as polarising as Donald Trump. While her calls for greater action by leaders have gained her many allies, everyone from Pauline Hanson to media figure Piers Morgan and football identity Sam Newman has waded in to decry her message.

But love her or hate her, it is clear that the young activist has made the world sit up and take note. Millions of people from over 150 countries joined the Global Climate Strike to demand an end to the age of fossil fuels, showing Thunberg is inspiring young and old to push for change.

The importance of standing for something

Thunberg’s UN speech highlighted the need for an authentic and pro-active approach to solving the climate change issue, rather than just “empty words”.

Locally, recent research by the Committee for Economic Development of Australia also found that Australians want the nation’s big businesses to speak out on issues such as the environment. For businesses, this means taking action not just as a branding exercise but as a way to effect real change.

In Australia’s financial sector, some key players have been taking a stance on environmental issues for decades. Responsible investment manager Australian Ethical, for example, recently celebrated the 30th anniversary of its Balanced Fund, and regularly speaks out on a range of climate-related topics.

Australian Ethical also recently pledged to protect five acres of Amazon rainforest for every new and referring super member, an innovative and groundbreaking initiative for the industry.

Product innovation

More broadly, an increasing number of local fund managers are routinely incorporating ESG issues into their investment decision-making, driven by increased investor demand, with ESG funds under management up 37% on last year.

One trend that has been gaining ground in the financial sector recently is the use of green bonds to help solve the climate crisis. Green bonds, also known as climate bonds, are specifically earmarked to be used for climate and environmental projects such as energy efficiency, pollution prevention, clean transportation and sustainable water management.

An example of how this is playing out locally is NAB’s partnership with TCorp in Australia’s largest ever green bond issuance, which will fund sustainable transport and infrastructure for the people of New South Wales. NAB is also leading the way in the banking sector by using green bonds to finance low-carbon residential housing, green commercial office buildings, electrified passenger rail projects and renewable energy.

In addition, TCorp recently flagged plans to launch a sustainability bond in the coming weeks, where proceeds are earmarked to finance a combination of green and social assets.

It is heartening to see that corporates and investors are taking their role in addressing climate change increasingly seriously. However as extreme weather events become the new normal and sea levels continue to rise, it is clear that there is more work to be done and the time to ramp things up is now.