While Australian consumers are used to juggling a handful of apps – LinkedIn for networking, Uber for rides and banking apps – Asian communities are embracing a different model: the super app.

A super app is an all-in-one mobile platform that combines multiple services – including messaging, payments, e-commerce, banking, food delivery and even insurance.

Think of them as digital Swiss Army knives, blending the functionality of WhatsApp, Uber, PayPal and banks within a single, integrated interface. This model helps build customer loyalty and creates data loops that fuel personalisation and product development.

For Australian financial services firms looking to expand in Asia, understanding the super app landscape is important.

Grab: Once known primarily as a ride-hailing service, Singapore’s Grab is now a full-spectrum super app, offering everything from food delivery to digital payments and financial services. In Q1 2025, its financial services arm, including GrabFin and digital banks, posted a 36% revenue surge to SGD $75 million, driven by a 30% jump in total loans disbursed (SGD $630 million) and a 56% increase in its total loan portfolio (SGD $566 million).

GXS, Grab’s digital bank venture with Singtel, has also seen rapid growth, accumulating SGD $1.4 billion in customer deposits. This financial expansion is underpinned by Grab’s vast user data, enabling it to offer more personalised financial products and challenge traditional banking models in Southeast Asia.

AlipayHK: In Hong Kong, mobile wallets are transforming payments. AlipayHK is the city’s most popular wallet, used by 42% of residents. It Octopus card, originally used primarily for transportation, has expanded its services and boasts 98% penetration. This underlines that seamless payments are not just a convenience, but also a competitive advantage.

WeChat: China essentially wrote the playbook for super apps, with WeChat and Alipay defining the model. WeChat’s 1.2 billion users can do everything from sending money to buying groceries within the same app. Both platforms now allow foreign visitors to link Visa and Mastercard, signalling a broader push into global finance.

KakaoTalk: South Korea’s KakaoTalk started as a chat app but has grown into a full financial ecosystem. KakaoBank now lets users apply for loans and invest without leaving the app, while KakaoPay has moved into insurance, selling more than 1.5 million travel policies in its first year. It’s a good example of how to build trust and engagement within a single platform.

LINE: Japan’s super app scene is less consolidated, but LINE is a standout, used by 70% of the population.

PayPay, a QR payments giant, recently partnered with Alipay+ to let Chinese tourists pay seamlessly across 3 million stores. It’s a step towards more integrated financial services, though the market remains more fragmented than its neighbours.

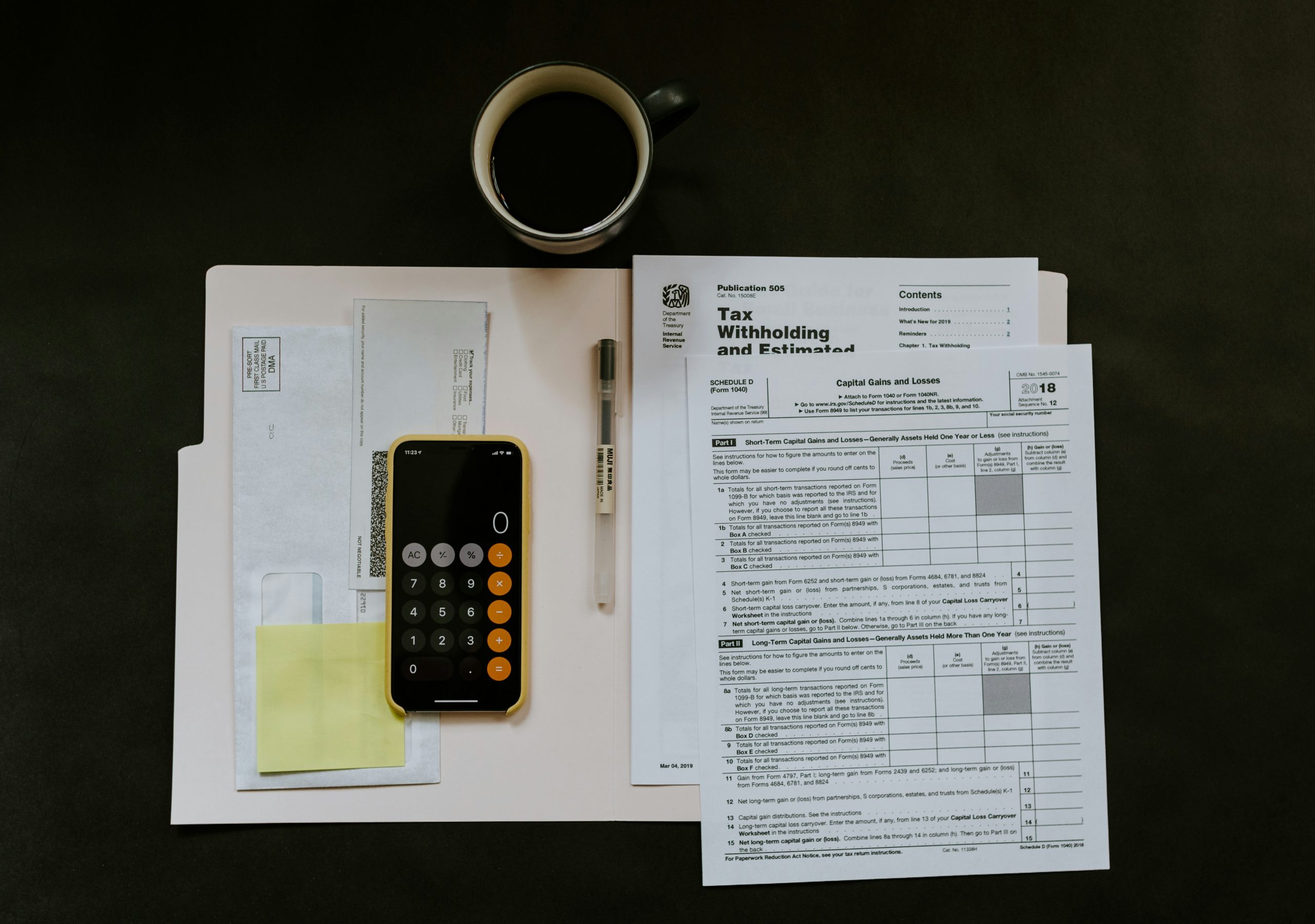

Takeaways for Australian financial services firms

- Super apps are no longer a distant trend – they’re reshaping consumer expectations across the region. Australian firms must be alert to the competitive threat and, more importantly, the opportunity to evolve.

- Think ecosystems, not apps: Build connected experiences that offer value across the entire customer journey – not just siloed features.

- Follow the data: Super apps win by using real-time data to personalise and anticipate customer needs. Local players should do the same.

- Integrate more deeply: Move beyond payments. Offering lending, insurance, and investing in one place can boost engagement and reduce churn.

- Design mobile-first: The smartphone is the new front door for financial services – build with that in mind.

The broader lesson? Harness the best ideas from around the world to fuel innovation at home. Put yourself in your client’s shoes – before your competitor shows up wearing a flashier pair.